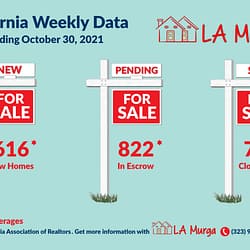

California Housing Market is Cooling

The California Housing Market is cooling down. This is the best moment for homebuyers who don’t want competition when placing their offers. In California, the housing market has begun to stabilize around the medium-term levels. Economic Factors The number of continuing claims for unemployment in California dipped to an 82-week low of 461,609 last week. Read more about California Housing Market is Cooling[…]