Today, the mortgage rates rose reaching the highest levels in 4 years. Financial markets saw a reason, after the release of the minutes from the Federal Reserve’s most recent policy meeting, for the recent trend in mortgage rates to continue rising.

Mortgage Rates highest in the last 4 years

Mortgage Rates highest in the last 4 years

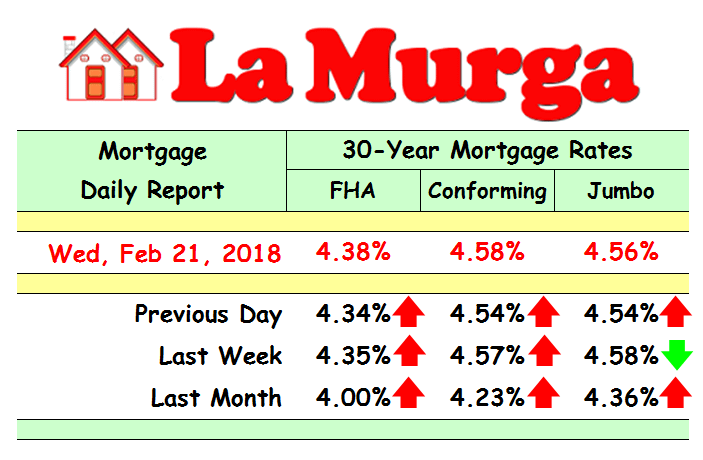

30 Year FHA Mortgage rate rose to 4.38%, while on January 2nd the rate was only 3.75%. This rate reached a 4-Year High today. Conforming 30-Year Mortgage Rate reached 4.58%, while on January 2nd the rate was 4.05% and the Mortgage rate for Jumbo loans reached today 4.56% while on January 2nd the rate was 4.20%. Other mortgage rates that reached a 4-Year high were the 15-Year Fixed-Rate Mortgage 3.93% and the 5/1-Year Adjustable-Rate Mortgage 3.52%.

The Mortgage Bankers Association (MBA) said the cause of the mortgage rates rose was the significantly lower number of applications for both purchase mortgages and refinancing during the week ended February 16 compared to the prior week. The expectations are that this week mortgage applications will continue going down.

Loan Originators’ opinion

Ted Rood, Senior Originator strongly suggests locking the rates if you are considering buying a home in the next 4 weeks. There’s still no apparent reason to believe rates will return to better levels anytime soon. Victor Burek from Churchill Mortgage says: “Lock as early as you can. The trend still favors higher rates and that trend does not look to change at the present”.

To find the current mortgage rates, click here.

Source: Mortgage Apps Finally Feeling Effects of Higher Rates