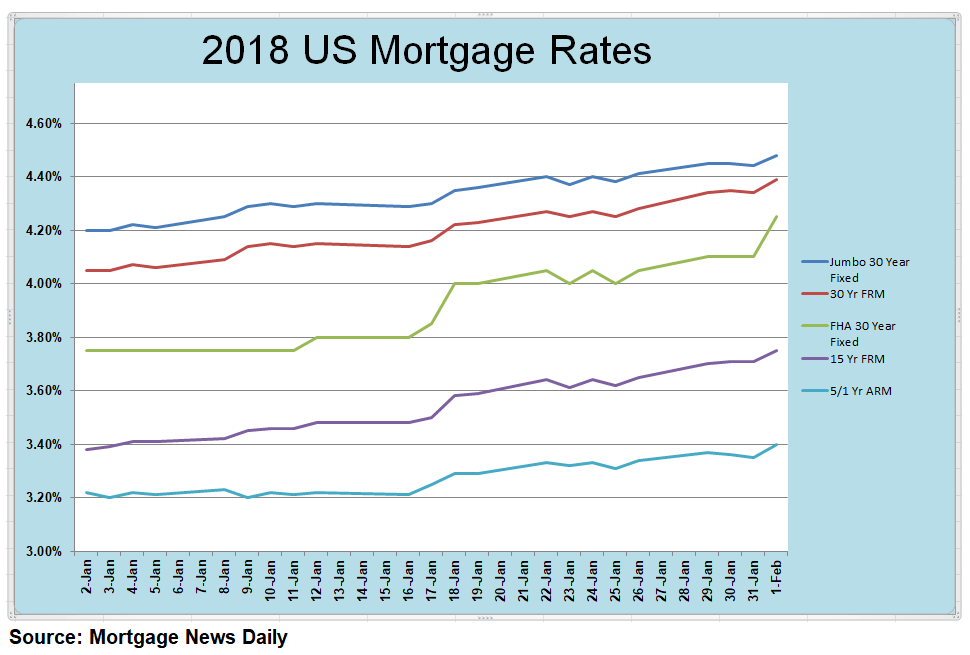

Financial Markets are surprised by the rising 2018 mortgage rates in the last days. The reason for these increases is the Investor’s concerns about the new fiscal spending initiatives causing an increased bond market supply. We all know a higher bond supply means lower bond prices and also means higher interest rates.

Here are some examples of the major increases:

• The FHA 30 Year Fixed reached 4.25% today. Last time this rate reached the same level was back in February 2014.

• The 15 Year Fixed Rate Mortgage reached 3.75% today. The previous record was in December 2013 when it reached 3.68%.

• The 5/1 Adjustable Mortgage Rate reached 3.40% today. The previous record was in January 2014 when it reached 3.27%.

New Investors are worried about the first group of Investors and thus are making trades to try to get ahead of them.

In the other side, the global monetary policy seems like it may be on the verge of a unified tightening. A removal of policy accommodation means big central banks are buying fewer bonds. Lower demand for bonds means lower bond prices and this means higher interest rates.

For Ted Rood, Senior Originator, the message is clear: “This isn’t a short-term phenomenon, it’s a long-term market trend. Lock early, any other strategy is swimming against a robust riptide”.

For our homebuyers the message is the same: If you are planning to buy a house, call your mortgage broker or lender, lock your mortgage rates fast, and take your final housing decisions soon. Next time thinking about buying a home, may involve a costly mortgage loan.

**** Update Information ****

Today, Friday, Feb 02, 2018 The market pushes higher the above mortgage rates:

• The FHA 30 Year Fixed maintained at 4.25%.

• The 15 Year Fixed Rate Mortgage reached 3.79%.

• The 5/1 Adjustable Mortgage Rate reached 3.42%.

We will see next week how the trends go on.