It is well known how student loans are one of the big reasons why young graduates can’t afford to buy a new house. However, what is new is that those student loans are reaching older people.

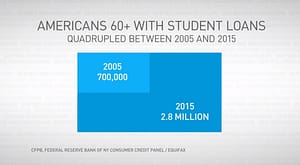

PBS reports today, that every year older Americans are struggling with these student debts. The number of people age 60 and older with student loans has quadrupled in the last 10 years, from 700K in 2005 to 2.8M in 2015. Also, the average debt amount raised from $12,100 to $23,500.

The reasons why these students loans are reaching older people are several:

a) 73% of them assumed or cosigned their children, or grandchildren, original student loans.

b) 27% of them never get the expected right salary level to repay the loan after they graduated.

c) Some families received a very basic disclosure information about the consequences of taking these loans, and there is no limit on how much debt they can take.

d) And of course, we never should forget that the student loans interest rates are very high and impossible to afford for some families.

What is know is that once you get the loan it will follow the cosigners until is paid. Most of the cosigners options are to move to other states with an affordable cost of living and getting partial jobs.

Today, the mortgage loans have enough disclosures to the borrowers, I don’t know why these student’s loans can get the same level of disclosures. My humble suggestion is you are in this situation and planning to buy a property, feel free to talk with a financial planner or a lender to help you manage this situation. Feel free to visit our Finding Lenders page

Source:

PBS Report – Older Americans struggle with student debt

https://www.youtube.com/watch?v=KpZNyfSkyo4